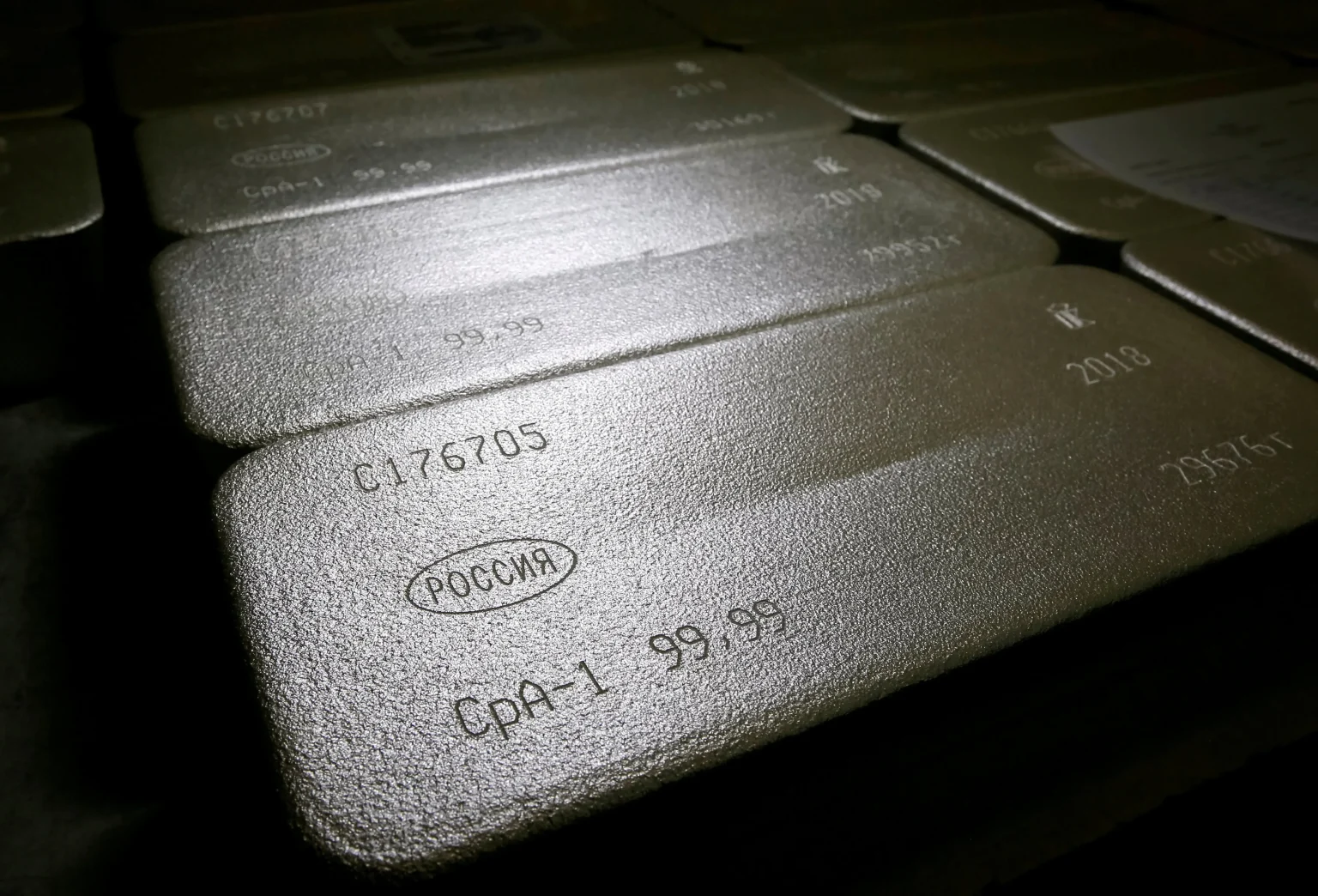

SILVER HITS RECORD HIGH AMID SUPPLY SHORTAGES – Silver prices have skyrocketed more than 90% this year, significantly outperforming gold

The spot price of silver in the London market broke through 57 U.S. dollars per ounce for the first time in history today, as expectations of U.S. interest rate cuts and supply shortages continue to spur an over 90-percent annual gain.

As of 10:00 Beijing time, spot silver was trading at 57.7 U.S. dollars per ounce, up about 2.3 percent over the previous trading day.

Silver prices have skyrocketed more than 90 percent this year, significantly outperforming gold. Analysts attribute the rally in silver and other precious metals to growing expectations of a Federal Reserve interest rate cut this month.

The Chicago Mercantile Exchange (CME)’s FedWatch indicates an 87.4-percent probability of a 25 basis point rate cut by the Federal Reserve in December.

In the trading market, supply shortages have persisted for years due to declining silver production and rising industrial demand. Silver inventories at global exchanges have fallen to their lowest levels in nearly a decade, while demand from sectors such as solar energy and electric vehicles continues to grow, adding to the constraints on supply. The shortages have also led to a surge in short-term silver lease rates in the leasing market.

Analysts suggest silver has been relatively undervalued within the precious metals complex, noting the gold-silver ratio currently stands at about 75:1, well above the 20-year average of around 60:1.

Bank of America’s Global Research division has raised its price forecast for silver to 65 U.S. dollars per ounce by 2026.